Florida’s Condo Crisis: New Laws, Falling Values, and Rising Costs

Florida’s Condo Crisis: New Laws, Falling Values, and Rising Costs

A perfect storm is brewing in Florida. Indeed, it is hitting condo owners hard. A shocking new reality has arrived. And it carries a massive price tag.

First, imagine opening your mail. You find a bill for thousands of dollars. Then, you learn it’s a special assessment. This is the nightmare unfolding across the state.

Moreover, this isn’t an isolated event. It is a warning sign for 1.5 million units. Therefore, you need to pay attention. Your investment could be next.

Key Point: New Florida laws are forcing massive, unexpected costs on condo owners. This changes everything for buyers and sellers.

The Post-Surfside Perfect Storm

This crisis did not happen in a vacuum. Instead, it is a direct result of new laws. Florida lawmakers acted after the tragic Surfside collapse. Their goal was to make buildings safer.

New Laws, New Financial Burdens

First, the state implemented stricter rules. Condos must now undergo milestone structural inspections. Additionally, they must have fully funded reserves. No more waiving reserve funding.

As a result, many buildings are facing a reckoning. Years of delayed maintenance are coming due. And the costs are proving to be enormous.

Many condo owners are facing unexpected and significant financial strain from new assessments.

A Compliance Crisis Unfolds

A recent USA Today report sounds the alarm. It details a compliance crisis for Florida’s condos. The laws (SB 154, HB 1021, HB 913) are complex. And the deadlines are fast approaching.

Furthermore, many associations were unprepared. They now face a difficult choice. Either levy huge assessments. Or risk legal and safety consequences.

The Alarming Financial Fallout

The financial impact is staggering. It is hitting owners from multiple angles. This creates a perfect storm of fear. And it is reshaping the market.

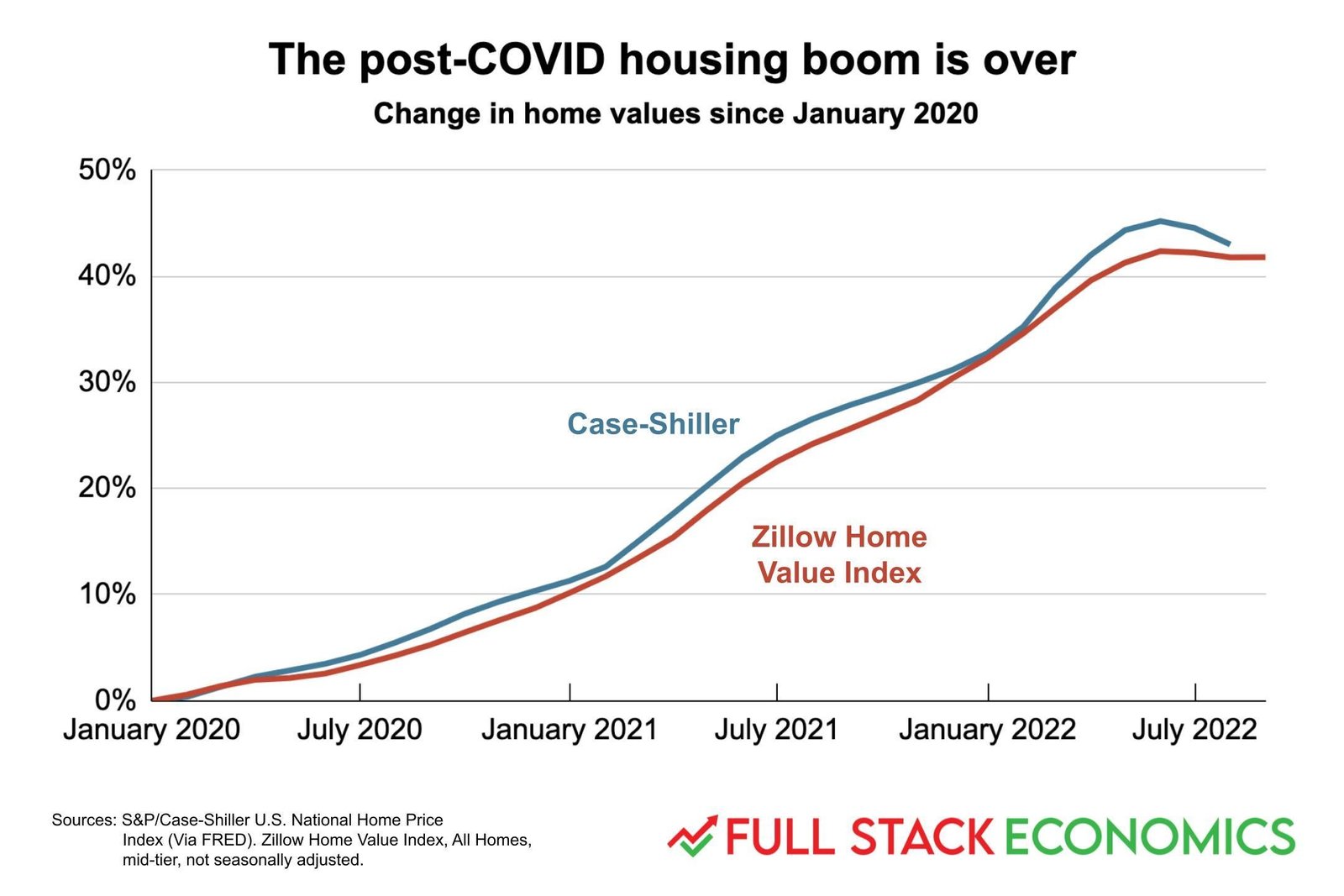

Property Values Plummet for Older Condos

First, property values are taking a hit. The USA Today article highlights a stunning 22% drop. This is for older high-rise buildings since 2024. Buyers are now scared of hidden costs.

Moreover, this creates a two-tiered market. Newer, compliant buildings are holding value. But older buildings are becoming financial traps.

Data shows a significant drop in value for older condos, a direct result of the new compliance laws.

Soaring Insurance and Special Assessments

Then, there are the direct costs. Insurance premiums are skyrocketing. And special assessments are becoming common. These can range from $10,000 to over $200,000.

As a result, many owners are in a tough spot. They cannot afford the payments. But they also cannot sell without a loss. It is a true financial crisis for many families.

Important Information: These new laws require a Structural Integrity Reserve Study. This study determines the remaining useful life of key building components and the cost to replace them.

What This Means for You

This crisis affects everyone. Whether you are a buyer, seller, or owner. You need a clear strategy. To navigate this new and complex landscape.

For Buyers: A New Level of Due Diligence

If you are buying in Miami, you must be careful. First, do not just look at the unit. You must investigate the entire building. Request all financial documents. Specifically, the budget and reserve study.

Then, ask about any pending assessments. And find out the status of the building’s compliance. We can help you ask the right questions. And get the right answers.

For Sellers: Transparency is Your Best Asset

If you are selling in Miami, transparency is key. You must disclose everything. Any known issues or pending assessments. Hiding problems will only lead to trouble.

Furthermore, a fully compliant and well-funded building is now a major selling point. We can help you position your property. To attract the right buyers. And get the best possible price.

Worried About the Condo Crisis?

The market is changing fast, but we are here to help. We have the expertise to guide you through the new laws and protect your investment.

Get Your Personalized Condo AnalysisWe are just a click away and we are always available. Contact us:

Frequently Asked Questions

A series of new state laws (SB 154, HB 1021, HB 913) enacted after the Surfside tragedy are forcing condo associations to fully fund their reserves and conduct expensive structural inspections, leading to massive, unexpected costs for owners.

Special assessments can vary dramatically, but they are often significant. Reports show they can range from $10,000 to over $200,000 per unit, depending on the building’s condition and the scope of required repairs.

Yes, for some segments. A USA Today report highlighted a 22% drop in property values for older high-rise condos since 2024, as buyers become wary of buildings with underfunded reserves and pending assessments.

It is crucial to perform enhanced due diligence. You must review the condo association’s financials, the latest Structural Integrity Reserve Study, and any pending assessments. We can help you navigate this complex process.

The Bottom Line

The Florida condo market is in transition. The new laws are creating short-term pain. But they aim for long-term safety and stability.

A Market of Prudence

First, prudence is now the key. For buyers, sellers, and associations. The days of kicking the can down the road are over. This is a new era of responsibility.

Opportunity in Chaos

For savvy investors, this chaos creates opportunity. Financially healthy buildings will become prime assets. And understanding the risks can lead to smarter investing in Miami. This also impacts those relocating to Miami and the rental market.

Your Trusted Partner

Finally, you need a trusted partner. Someone who understands this new landscape. We are here to guide you. We have the expertise to protect your interests.

Don’t face the condo crisis alone. Contact us for a personalized strategy session. Let’s find your secure place in the new Florida market.