Florida Insurance Market Stabilizing: Citizens Policies Drop

Florida’s homeowners insurance market—widely characterized as being in “crisis” throughout 2022-2024—is showing significant signs of stabilization as Citizens Property Insurance Corporation’s policy count has declined to levels not seen since 2019. This positive development indicates that private insurers are returning to Florida, competition is increasing, and premium growth is moderating after years of dramatic increases.

For Miami homebuyers and sellers navigating real estate decisions, understanding this insurance market improvement provides critical context for affordability calculations and long-term ownership planning. While Florida insurance remains more expensive than most states, the trajectory has shifted from deteriorating crisis to stabilizing recovery—a fundamental change that should influence how buyers, sellers, and relocators evaluate Florida real estate opportunities.

This analysis examines Citizens Insurance policy trends, explains what declining policy counts signal about market health, details why private insurance options are expanding, and provides practical guidance for Miami buyers navigating the improving but still-challenging insurance environment in 2025-2026.

Insurance Fears vs. Actual Market Data in Florida

Throughout 2022-2024, media coverage of Florida’s insurance market emphasized carrier exits, premium increases exceeding 40% annually, and Citizens Insurance policy growth as private options disappeared. These narratives, while accurate during that period, created perceptions that Florida’s insurance situation was unsolvable and would indefinitely worsen.

This negative framing, combined with legitimate affordability concerns, caused some potential buyers to avoid Florida entirely or delay purchases waiting for improvement. Real estate professionals reported buyers walking away from transactions after receiving insurance quotes doubling their affordability assumptions, while sellers faced longer marketing times as insurance concerns complicated negotiations.

However, recent data reveals a markedly different trend. Citizens Insurance—Florida’s state-backed insurer of last resort—has experienced sustained policy reductions bringing its total policy count below levels seen since 2019. This decline doesn’t indicate Floridians are abandoning insurance coverage; rather, it signals that private market alternatives have become available, allowing policyholders to transition from Citizens to competitive private carriers.

The distinction matters enormously. When Citizens policy counts rise, it indicates private insurers are exiting Florida and homeowners have no options except the state-backed insurer—a clear crisis indicator. When Citizens counts decline despite continued population growth and real estate development, it means private insurers are actively writing new business and assuming risk from Citizens through depopulation programs—a clear stabilization indicator.

For Miami real estate participants, this shift from crisis to stabilization creates opportunities. Buyers previously discouraged by insurance challenges can now access competitive private market options rather than being forced into Citizens. Sellers can market properties with confidence that qualified buyers will secure reasonable insurance rather than facing last-minute transaction failures due to insurance unavailability.

Citizens Insurance Shrinkage Explained: What the Numbers Mean

Citizens Property Insurance Corporation serves as Florida’s insurer of last resort, providing coverage when private insurers decline to offer policies or when private options are prohibitively expensive. By design, Citizens should remain small, covering only properties that genuinely cannot access private market insurance at reasonable rates.

Policy Count Drops to Pre-2020 Levels

Citizens’ policy count declined significantly through 2024-2025, falling below 1 million policies for the first time since 2019. At its peak in late 2022, Citizens held approximately 1.3 million policies as private insurers fled Florida following hurricane losses and litigation costs. The subsequent 20%+ reduction represents one of the fastest depopulation periods in Citizens’ history.

This decline occurred despite Florida’s continued population growth, new construction deliveries, and strong real estate market fundamentals. The state added hundreds of thousands of residents during this period, meaning private insurers absorbed not only policies leaving Citizens but also substantial new business from population growth and development.

The geographic distribution of departures reveals important patterns. Coastal counties including Miami-Dade, Broward, and Palm Beach saw particularly strong private market re-entry as insurers became more comfortable with hurricane risk following years without major storm impacts in Southeast Florida. Interior counties also benefited from private carrier expansion, though at more modest rates.

Policy type breakdown shows balance between personal lines (homeowners policies for primary residences) and commercial residential coverage (landlord policies, condo associations). Both segments experienced private market alternatives expansion, indicating broad-based carrier appetite for Florida risk rather than cherry-picking only the most profitable niches.

Depopulation Strategy Working as Intended

Citizens employs several mechanisms to facilitate policy transitions to private insurers, collectively termed “depopulation.” These programs incentivize private carriers to assume Citizens policies, reducing the state’s exposure to catastrophic hurricane losses while expanding policyholder options.

Take-out programs allow private insurers to assume entire blocks of Citizens policies, typically targeting specific geographic areas or property types. These bulk transfers happen without policyholder action—Citizens notifies affected policyholders that their coverage is transferring to a specific private carrier. Policyholders can decline the transfer and remain with Citizens, but most accept the transition to private coverage.

Clearinghouse mechanisms require Citizens to offer new applications to private insurers before issuing Citizens policies. If a private carrier offers coverage within specified price parameters (typically within 20% of Citizens’ premium), the applicant must accept the private option or forgo Citizens coverage. This prevents Citizens from writing new business when private alternatives exist.

Voluntary market incentives including rate flexibility, reduced regulatory constraints, and other mechanisms encourage private insurers to write business directly rather than forcing consumers into Citizens. Recent legislative reforms expanded insurer pricing flexibility, reducing the competitive advantage Citizens held when rates were heavily regulated.

The combination of these mechanisms created conditions where Citizens shrank rapidly while private market options expanded. The strategy’s success validates Florida’s approach to managing its residual market—maintaining Citizens as a true backstop rather than allowing it to become a primary market insurer competing with private carriers.

Private Insurers Returning to Florida Market

The most significant indicator of market stabilization is private insurers actively returning to Florida and expanding their footprints after years of exits and capacity reductions. This re-entry takes multiple forms across different carrier types.

New carriers have formed specifically to write Florida homeowners insurance, capitalizing on improved market conditions and rate adequacy. These companies, often backed by private equity or reinsurance capital, see opportunity in a market where rates have adjusted to reflect actual risk and legal reforms have reduced litigation costs that previously made Florida unprofitable.

Existing Florida carriers that survived the crisis years are expanding their policy counts and geographic footprints. Carriers that previously stopped writing new business or restricted coverage to low-risk properties have relaxed underwriting standards and increased appetite for Florida exposure.

Out-of-state carriers that exited Florida during the crisis period are evaluating re-entry strategies. While large national carriers remain cautious, regional and specialty carriers are testing Florida waters with limited writings, potentially expanding if results prove profitable.

The carrier diversity increase benefits consumers through competition. When only a handful of carriers write Florida business, they exercise pricing power and impose restrictive underwriting requirements. As more carriers compete for business, premiums moderate, coverage terms improve, and policyholders gain negotiating leverage when shopping for insurance.

Private Insurance Market Stabilization Signals

Multiple indicators beyond Citizens policy counts confirm that Florida’s private insurance market is stabilizing after years of turmoil.

New Carriers Entering Florida

Approximately 15-20 new insurance carriers have entered Florida or been approved for licensure since 2023, indicating confidence in the state’s insurance market future.

New carrier formation typically follows this pattern: capital formation from private equity, reinsurance markets, or experienced insurance executives, Florida Office of Insurance Regulation application and approval processes, initial conservative underwriting focusing on lower-risk properties, and gradual expansion as the company gains experience and confidence in Florida exposure.

New carriers often leverage modern technology and data analytics to price risk more accurately than legacy carriers. Superior modeling of hurricane risk, property-specific characteristics, and loss history allows these companies to identify profitable niches and price competitively while maintaining underwriting discipline.

The presence of new entrants creates competitive pressure on existing carriers. Legacy companies that maintained conservative underwriting or high pricing during the crisis now face competition from nimble new carriers willing to write business at competitive rates. This competitive dynamic benefits consumers through improved options and pricing.

Existing Insurers Expanding Coverage

Carriers that remained in Florida throughout the crisis are expanding their policy counts and relaxing underwriting restrictions. Companies that previously declined properties over certain ages, with specific roof types, or in coastal zones are now writing coverage for these previously excluded properties.

This expansion indicates improved carrier confidence in profitability. Insurers only broaden underwriting when they believe they can price risk accurately and generate acceptable returns. The willingness to write previously declined risks signals that rate levels have adjusted sufficiently to cover expected losses plus operating expenses and profit margins.

Expanded coverage also reflects reduced uncertainty about legal costs. Florida’s insurance litigation created massive unpredictability as carriers faced lawsuits over minor claims that escalated into six-figure settlements. Recent legal reforms have substantially reduced this litigation, allowing insurers to predict costs more accurately and price accordingly.

Existing carrier expansion particularly benefits buyers in coastal Miami-Dade and Broward counties where hurricane risk created the most conservative underwriting during crisis years. Properties that could only access Citizens or very expensive admitted carriers now have multiple private options at more competitive pricing.

Competition Driving Better Options

Increased carrier competition manifests in several consumer-friendly ways. Premium pricing has become more competitive as carriers vie for market share, discounts and incentives for risk mitigation measures (hurricane shutters, impact-resistant roofing, newer construction) have expanded, coverage terms have become more flexible as carriers compete on product features beyond just price, and customer service quality has improved as carriers recognize retention importance in competitive markets.

This competitive environment particularly benefits buyers willing to shop multiple carriers. During crisis years, buyers were grateful to find any coverage regardless of price or terms. Today’s market rewards comparison shopping, as quotes from different carriers for identical properties can vary by 20-40% based on each company’s risk models, competitive positioning, and profit targets.

Independent insurance agents benefit from expanded carrier options by offering clients true choice rather than placing everyone with the same one or two carriers willing to write Florida business. This expanded placement capacity allows agents to match clients with carriers best suited to their specific risk profiles and budget constraints.

Why Florida Insurance Premium Increases Have Slowed

Florida homeowners insurance premium increases, which exceeded 40% annually during 2021-2023, have moderated significantly in 2024-2025. While premiums remain elevated compared to pre-2020 levels, the rate of increase has slowed dramatically—indicating market stabilization.

Legislative Reforms Reducing Lawsuit Costs

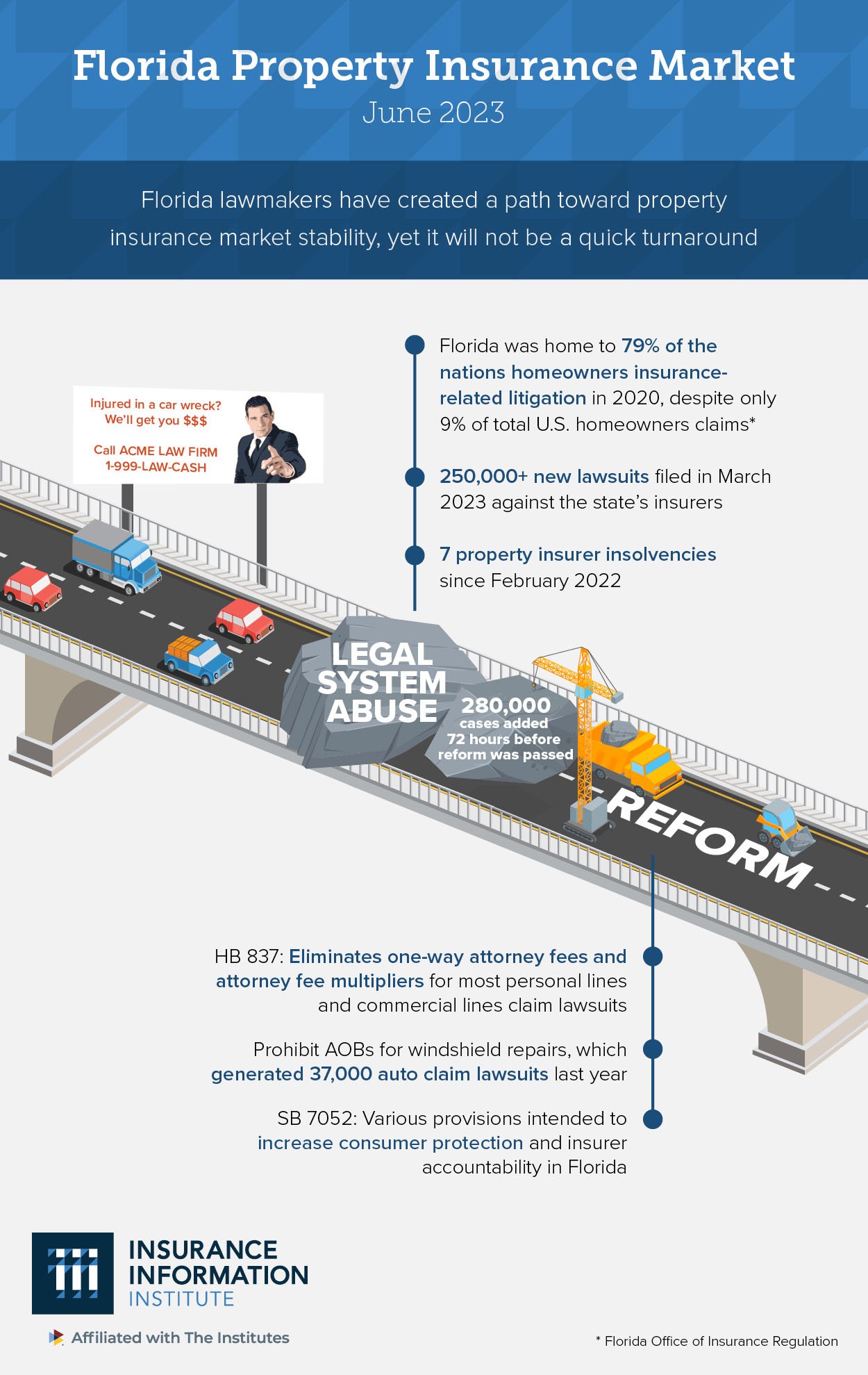

Florida’s legislature passed comprehensive insurance litigation reforms in 2022-2023 targeting the assignment of benefits (AOB) fraud and excessive attorney fees that drove massive legal costs for insurers. These reforms included AOB restrictions limiting contractors’ ability to file claims without homeowner involvement, attorney fee caps in insurance disputes, shorter statute of limitations for filing property claims, and increased requirements for proving roofing damage in older properties.

The litigation reforms’ impact has been substantial. Insurance lawsuits in Florida declined by over 50% following the legislative changes, dramatically reducing legal defense costs and fraudulent claim settlements that previously inflated premiums. Carriers that faced litigation on 20-30% of claims now experience lawsuit rates under 10%, bringing Florida closer to national norms.

Reduced litigation creates positive feedback loops. Lower legal costs mean carriers require less premium revenue to cover expenses, allowing rate moderation. This affordability improvement attracts more carriers to Florida, increasing competition that further moderates pricing. The virtuous cycle contrasts sharply with the vicious cycle of rising costs, carrier exits, and premium increases that characterized 2020-2022.

Legal reform sustainability remains critical. If future legislative sessions reverse these pr dynamic particularly helps Florida where reinsurance represents a larger portion of total costs than in non-catastrophe states.

Reinsurance Market Stabilization

The global reinsurance market—which provides insurance for insurance companies—has stabilized after several years of volatility driven by global catastrophe losses and inflation. Reinsurance costs represent a significant portion of Florida homeowners insurance premiums. When reinsurance costs rise, primary carriers must pass those costs directly to policyholders.

Increased capital entering the reinsurance market, coupled with Florida’s legislative reforms reducing primary carrier risk, has led to more favorable reinsurance terms. This stabilization reduces one of the largest cost drivers for Florida insurers, allowing them to moderate premium increases for consumers.

The Florida Hurricane Catastrophe Fund—a state-backed reinsurance program—also expanded capacity, providing more affordable reinsurance options for carriers writing Florida business. This public reinsurance availability cushions the market against future private reinsurance volatility.

Hurricane Preparedness Improvements

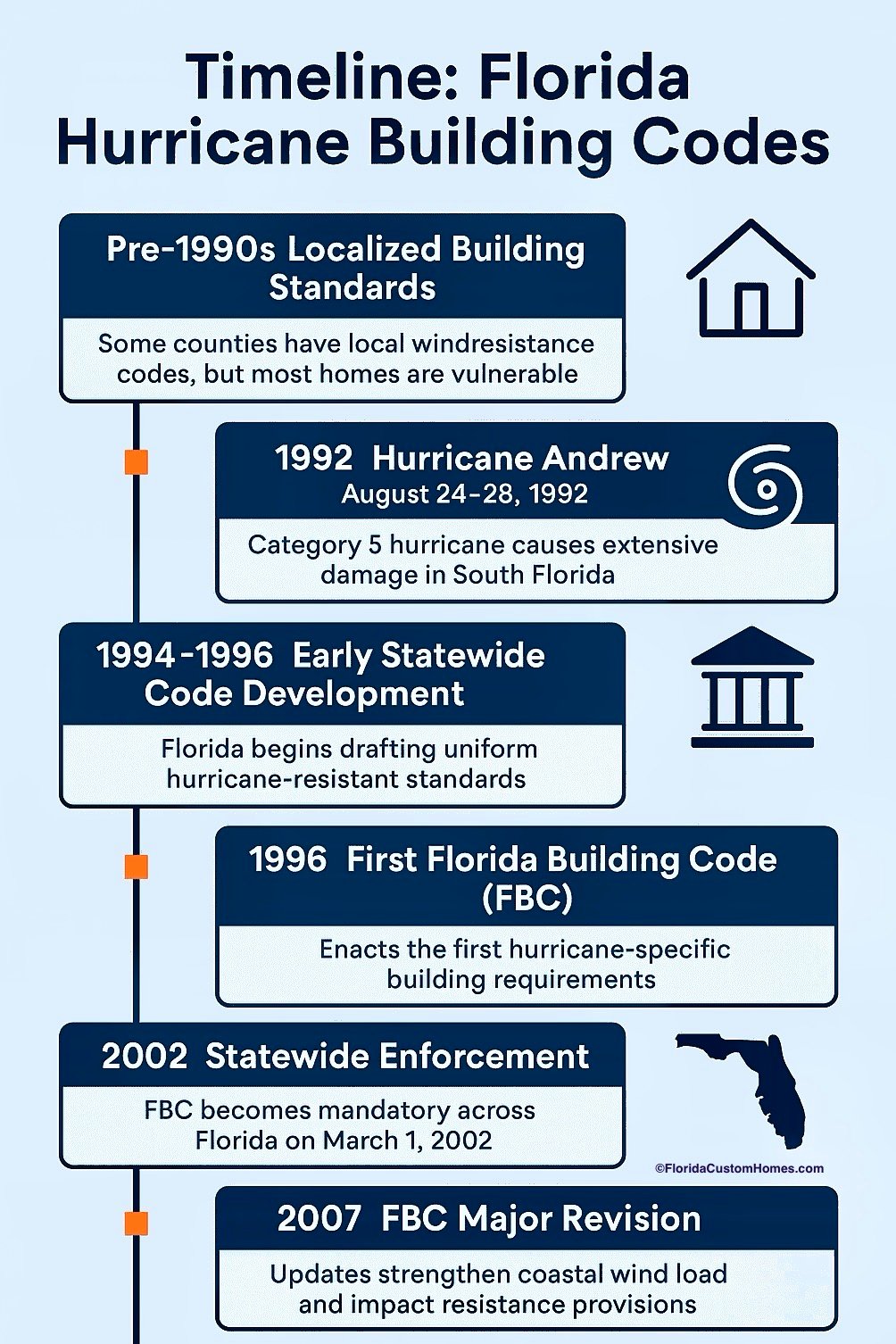

Florida’s building code improvements, mandatory hurricane mitigation measures, and homeowner investments in property

What Miami Homebuyers Should Expect in 2025-2026

Despite stabilization, Florida insurance remains a significant cost of homeownership. Miami buyers must budget realistically and understand the factors driving premium variations.

Realistic Premium Ranges by Property Type

Premiums vary widely based on property type, age, and location. As a general guide for 2025-2026:

- New Construction (Post-2002 Code): $3,000 – $6,000 annually for a standard single-family home.

- Older Homes (Pre-2002 Code): $5,000 – $10,000+ annually, depending on roof age and mitigation features.

- Condominiums: Premiums are typically lower for individual unit owners ($1,500 – $3,500) because the master policy covers the building structure. However, buyers must factor in the cost of the master policy, which is paid through HOA fees and is also rising.

Geographic Variations Across Miami-Dade

Premiums are highest in coastal areas and lowest in inland areas further from the coast. Miami Beach, Key Biscayne, and coastal areas of Coral Gables and Coconut Grove will command the highest rates due to wind and storm surge risk. Western Miami-Dade (e.g., Doral, Kendall) benefits from lower wind risk and is often priced more favorably.

Waterfront vs. Inland Premium Differences

The premium differential between waterfront and inland properties deserves special attention given Miami’s real estate market’s emphasis on water access and water views. Waterfront properties often require additional flood insurance (separate from homeowners insurance) and face higher windstorm premiums due to proximity to open water. Buyers must budget for both homeowners and flood insurance, which can easily double the total insurance cost compared to a similar inland property.

How to Navigate Florida’s Improving Insurance Market

Buyers can take proactive steps to secure the best possible coverage and pricing.

Getting Multiple Competitive Quotes

The return of private carriers means competition is back. Buyers should obtain quotes from at least three different carriers—both large national brands and smaller, Florida-focused specialty carriers—to compare pricing and coverage terms. The difference between the highest and lowest quote can be thousands of dollars.

Understanding Coverage Options and Trade-offs

Buyers should carefully review deductibles, especially the hurricane deductible (often 2% or 5% of the dwelling coverage). A higher deductible lowers the premium but increases the out-of-pocket cost after a storm. Buyers must choose a deductible they can comfortably afford.

Working With Independent Agents

Independent insurance agents work with multiple carriers and can shop the market efficiently. They understand the nuances of Florida’s market and can advise on mitigation credits and carrier-specific underwriting requirements. Their expertise is invaluable in securing the best coverage.

Strategic Insurance Considerations for Miami Buyers

Insurance costs must be integrated into the overall affordability calculation.

Impact on Affordability Calculations

High insurance costs directly impact the maximum mortgage amount a buyer can qualify for, as lenders include PITI (Principal, Interest, Taxes, Insurance) in their debt-to-income ratio calculations. A $5,000 annual premium increase can reduce a buyer’s purchasing power by tens of thousands of dollars.

Escrow Account Planning

Most lenders require insurance premiums to be paid through an escrow account. Buyers should ensure their escrow analysis is accurate and accounts for potential future premium increases to avoid escrow shortages and unexpected lump-sum payments.

Long-Term Cost Projections

While the market is stabilizing, buyers should assume insurance costs will continue to rise, albeit at a slower pace. Budgeting for a 5-10% annual increase in insurance costs provides a realistic long-term ownership projection.

insurance quotes or connecting them with knowledgeable agents reduces transaction friction and prevents last-minute

Ready to Invest in Miami’s Luxury Market?

Whether you are seeking a primary residence, a strategic investment, or a multi-unit compound, our team specializes in navigating the exclusive South Florida luxury real estate market. Contact us today for confidential, expert guidance.