Florida’s Insurance Reforms Are Paying Off for Homeowners: Rate Decreases Signal Market Stabilization

In a remarkable turnaround for Florida’s beleaguered property insurance market, 17 insurance companies have filed for rate decreases following the state’s comprehensive 2023 legislative reforms—signaling that aggressive policy changes targeting excessive litigation and fraud are finally creating the competitive, stable market homeowners desperately need.

November 15, 2025 – Good news for Florida homeowners: Insurance reforms are working.

In a remarkable turnaround for Florida’s beleaguered property insurance market, 17 insurance companies have filed for rate decreases following the state’s comprehensive 2023 legislative reforms—signaling that aggressive policy changes targeting excessive litigation and fraud are finally creating the competitive, stable market homeowners desperately need.

This positive development, highlighted by the Sun Sentinel (Opinion) on November 10, 2025, counters the prevailing narrative of skyrocketing insurance costs that has dominated Florida real estate discussions for three years. While challenges remain—particularly for coastal properties in Miami Beach, Sunny Isles Beach, and Fort Lauderdale—the trend toward rate reductions represents a potential inflection point where Florida’s insurance crisis transitions from catastrophic to manageable.

For current homeowners throughout Miami-Dade, Broward, and Palm Beach counties facing insurance premiums that doubled or tripled since 2021, rate decreases offer tangible relief. For prospective buyers considering Brickell condos, Coral Gables estates, or Coconut Grove waterfront homes, improving insurance affordability removes a major obstacle to homeownership.

This comprehensive analysis explores what Florida’s 2023 insurance reforms entailed, why they’re working, which companies are reducing rates, what challenges remain, and how homeowners can capitalize on the improving market to reduce their costs.

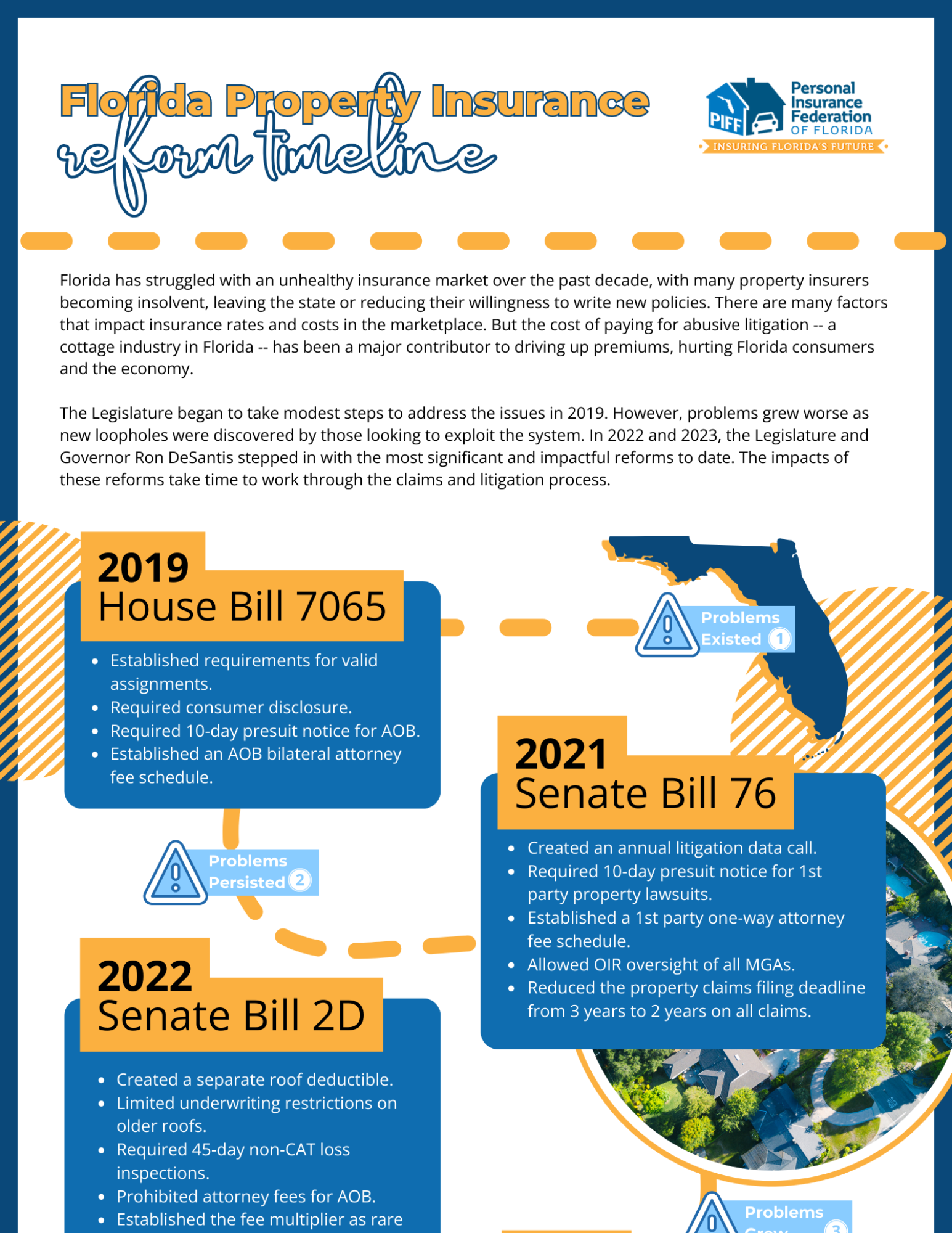

Understanding Florida’s Insurance Crisis: The 2019-2023 Meltdown

Before appreciating the reforms’ success, understanding the crisis they addressed is essential.

The Perfect Storm (2019-2023)

Florida’s property insurance market experienced catastrophic failure driven by multiple converging factors:

Hurricane Losses:

- Hurricane Michael (2018): $25B in insured losses

- Hurricane Irma (2017): $50B in insured losses

- Hurricane Ian (2022): $112B total damage, $60B+ insured

- Cumulative impact: Insurers paid out far more than premiums collected

Litigation Abuse:

- Florida accounted for 79% of U.S. homeowner insurance lawsuits despite having only 9% of claims

- “Assignment of benefits” (AOB) scams: Contractors inflating claims, suing insurers

- Public adjusters and attorneys generating frivolous litigation

- Legal costs consuming 71 cents of every insurance dollar in Florida vs. 5 cents nationally

Reinsurance Crisis:

- Global reinsurers (insurance for insurance companies) fled Florida market

- Remaining reinsurers raised rates 30%-100%+

- Florida insurers couldn’t obtain affordable reinsurance = insolvency risk

Market Exits:

- 8 insurers became insolvent 2020-2022 (hundreds of thousands of policies transferred to Citizens Property Insurance, state-backed “insurer of last resort”)

- Major national carriers reduced Florida exposure or exited entirely

- Farmers, Allstate, AAA stopped writing new policies

- State Farm dramatically restricted new business

Premium Explosion:

- 2019-2023: Florida homeowners insurance premiums increased 40%-300%

- Average premium: $2,500 (2019) → $6,000-$7,500 (2023)

- Coastal properties: $8,000-$15,000+ annually

- Some properties became “uninsurable” at any price

Real Estate Impact:

- Condo market crisis: Special assessments + insurance = affordability collapse

- Buyers walking from deals when insurance quotes exceeded budgets

- Brickell, Sunny Isles, Aventura condo values declining

- South Florida real estate volume dropping 20%-40%

By 2023, Florida’s insurance market was in death spiral: Rising premiums → policy cancellations → smaller risk pools → more premium increases → more exits.

Citizens Property Insurance: The Taxpayer Risk

As private insurers fled, Citizens Property Insurance (state-backed insurer) absorbed policies:

Growth:

- 2019: 420,000 policies

- 2023: 1.3 million+ policies (peak)

- Increase: 210% in 4 years

Why This Matters:

- Citizens is backed by Florida taxpayers

- Major hurricane hitting while Citizens holds 1.3M policies = potential taxpayer assessments on ALL property insurance policies statewide

- Could trigger “death spiral” of premium surcharges causing more market exits

Bottom Line: By 2023, Florida faced existential insurance crisis threatening real estate market and state economy.

The 2023 Legislative Reforms: What Changed

Facing crisis, Florida Governor Ron DeSantis and legislature passed sweeping insurance reforms in December 2022 special session and May 2023 regular session.

Key Reform Provisions

HB 837 (Tort Reform):

Eliminated One-Way Attorney Fees:

- Old rule: If homeowner won insurance lawsuit, insurer paid homeowner’s attorney fees (but reverse didn’t apply)

- Problem: Incentivized frivolous lawsuits (attorneys had nothing to lose)

- New rule: Each party pays own attorney fees

- Impact: Dramatically reduced litigation incentive

Reduced Statute of Limitations:

- Old rule: 5 years to file insurance claim lawsuit

- Problem: Allowed stale claims and litigation farming

- New rule: 2 years to file lawsuit (aligns with most states)

- Impact: Reduces litigation exposure for insurers

Restricted Public Adjusters:

- Old rule: Public adjusters could solicit claims aggressively

- Problem: Inflated claims, encouraged litigation

- New rule: Restrictions on solicitation, contingency fees

- Impact: Reduced claim inflation

Modified Bad Faith Standards:

- Old rule: Insurers faced “bad faith” lawsuits if claim handling perceived unfair

- Problem: Vague standards encouraged litigation

- New rule: Clearer standards, burden of proof requirements

- Impact: Reduced frivolous bad faith claims

SB 2-A (Market Stabilization):

Depopulation of Citizens:

- Requires Citizens to reduce policy count by allowing private insurers to assume policies

- Creates incentives for private market to re-enter

- Goal: Reduce taxpayer exposure

Reinsurance Fund:

- State-backed reinsurance program helping private insurers afford reinsurance

- Reduces carrier costs = potential premium reductions

Regulatory Streamlining:

- Faster rate approval process (encourages market entry)

- Reduced regulatory burden for new carriers

Fraud Prevention:

- Enhanced penalties for insurance fraud

- Increased enforcement resources

- Contractor licensing tightening

Political Context

Bipartisan Support:

- Rare issue where Florida Democrats and Republicans aligned

- Homeowner crisis transcended party politics

- Insurance lobby supported reforms (obviously)

- Trial attorney lobby opposed (lost this battle)

DeSantis Priority:

- Governor made insurance reform signature 2023 issue

- Campaigned on “fixing the insurance crisis”

- Staked political capital on success

Implementation Timeline:

- Tort reforms: Effective July 2023

- Market reforms: Rolling implementation through 2024-2025

- Rate impacts: Beginning to show late 2024-2025

The Results: 17 Companies File for Rate Decreases

The Numbers

According to Sun Sentinel reporting and Florida Office of Insurance Regulation:

Rate Decrease Filings (2024-2025):

- 17 insurance companies filed for rate decreases

- Decrease amounts vary: -2% to -15% depending on company and coverage

- Timing: Primarily Q3-Q4 2024 through Q1 2025

- Implementation: Most effective late 2024 or early 2025

Compare to Previous Years:

- 2021-2023: Zero major insurers filed rate decreases (all increases)

- 2020: Minimal decreases

- 2024-2025: 17 companies = dramatic reversal

Market Re-Entry:

- 5-7 new carriers entered Florida market 2024 (attracted by reformed environment)

- Several national carriers resumed writing new policies after years-long pause

- Competition increasing = downward pricing pressure

Citizens Depopulation:

- Citizens policies declining from 1.3M peak (2023) to ~900,000 (late 2024)

- Private market absorbing 400,000+ policies

- Reduces taxpayer risk

Which Companies Are Reducing Rates?

While specific company names aren’t always public during regulatory review, categories include:

Regional Florida Carriers:

- Mid-sized insurers specializing in Florida market

- Examples: Universal Property & Casualty, Federated National, TypTap

- Strategy: Gain market share through competitive pricing

Returning National Carriers:

- Larger insurers testing Florida re-entry

- Limited filings but strategically significant

New Market Entrants:

- Startups and specialty carriers attracted by reformed market

- Often target specific segments (new construction, luxury properties)

Citizens “Take-Out” Companies:

- Insurers specifically created to assume Citizens policies

- Incentivized by state programs

Important Note: Not all homeowners will see decreases:

- High-risk properties (coastal, older construction, claims history) may still see increases

- Decreases concentrated in lower-risk segments

- Geographic variations (Brickell inland vs. Miami Beach oceanfront experience different markets)

Average Decrease Amounts

Reported Ranges:

- Minor decreases: -2% to -5% (most common)

- Moderate decreases: -5% to -10% (several carriers)

- Significant decreases: -10% to -15% (rare, specific segments)

Dollar Impact Examples:

$4,000 annual premium (typical inland home):

- -5% decrease = $200 annual savings

- -10% decrease = $400 annual savings

$8,000 annual premium (coastal condo):

- -5% decrease = $400 annual savings

- -10% decrease = $800 annual savings

$12,000 annual premium (oceanfront property):

- -5% decrease = $600 annual savings

- -10% decrease = $1,200 annual savings

While not massive, directional change matters: down vs. endless up.

Why the Reforms Are Working

Reduced Litigation Costs

Data Showing Impact:

Lawsuit Filings:

- 2022: ~100,000 homeowner insurance lawsuits filed in Florida

- 2024: ~35,000 lawsuits (estimated, -65%)

- Reduction: Two-thirds drop in litigation

Attorney Fee Costs:

- Insurers’ legal costs declining 30%-50%

- Money previously spent on attorneys now available for claims or rate reductions

Claim Inflation:

- AOB abuse declining (contractors can’t inflate claims as easily)

- Public adjuster restrictions reducing claim costs

Fraud Prosecution:

- Enhanced enforcement seeing results

- Fewer fraudulent claims = lower costs

Bottom Line: Litigation expenses that consumed 71 cents of every premium dollar now consuming 20-30 cents—freeing capital for competitive pricing.

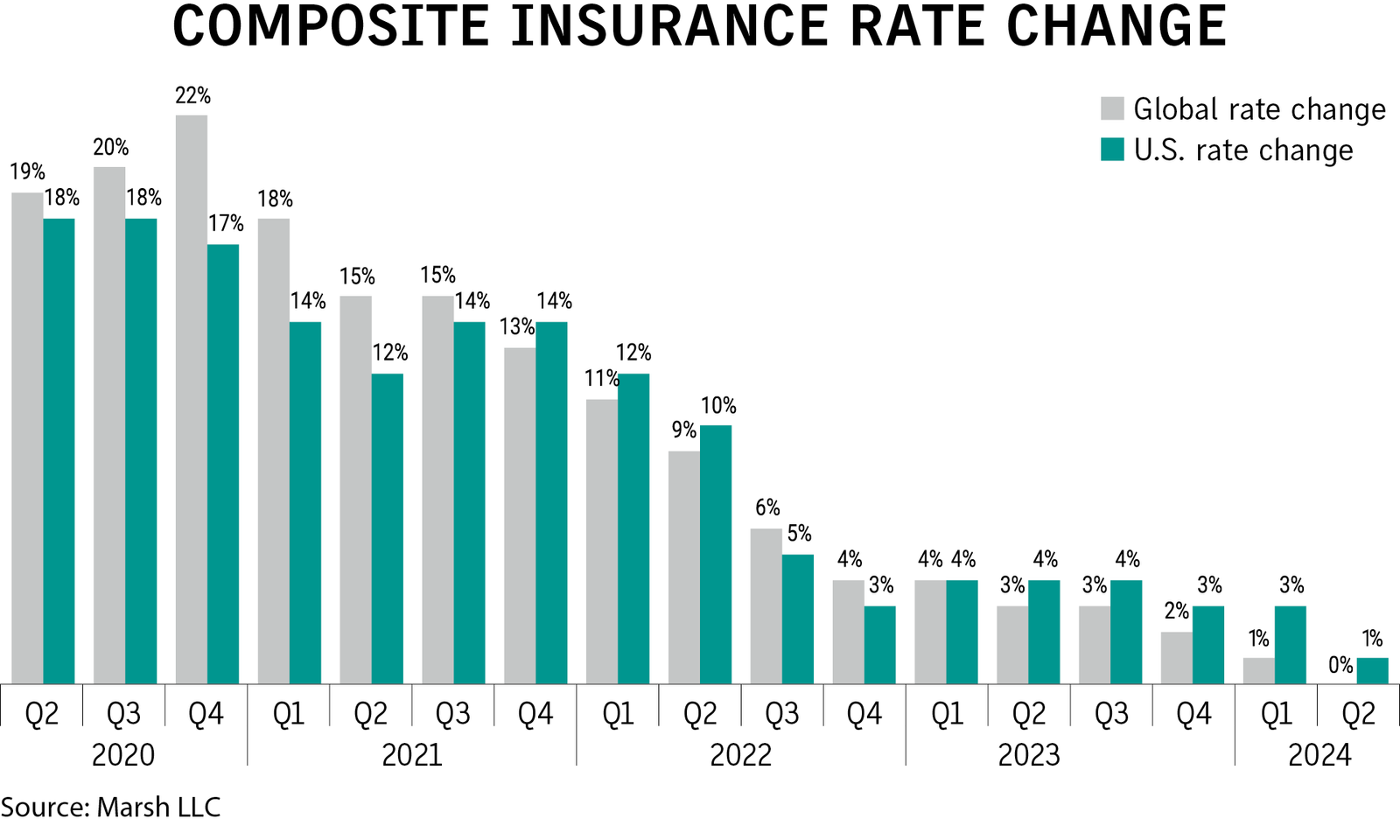

Reinsurance Stabilization

Global Reinsurer Confidence:

- Florida’s reforms noticed internationally

- Reinsurers more willing to cover Florida risk

- Reinsurance rates stabilizing or declining modestly

State Reinsurance Fund:

- Provides backstop reducing private reinsurer exposure

- Lowers costs for primary insurers = premium relief

Market Dynamics:

- More reinsurance capacity available

- Competition among reinsurers returning

- Rates dropping 10%-20% from 2023 peaks (still elevated vs. 2019)

Competition Returning

Market Entry Incentives:

- Reformed legal environment reduces operating risk

- Regulatory streamlining makes entry easier

- Profit potential improving

New Carriers 2024:

- Estimated 5-7 new insurers writing policies

- Focused on low-to-moderate risk properties

- Forcing incumbent carriers to compete on price

Existing Carriers Expanding:

- Companies that restricted new business now opening

- Coverage territory expansions

- Product line extensions

Result: More insurers = buyer leverage = lower premiums.

Citizens Depopulation Success

Private Market Assumption:

- 400,000+ policies moved from Citizens to private carriers

- Reduces state exposure

- Creates larger competitive market

“Take-Out” Programs:

- Insurers incentivized to assume Citizens policies

- Brings new capital into market

- Distributes risk across multiple carriers

Policyholder Options:

- Homeowners leaving Citizens have choices

- Can shop among multiple carriers

- Price competition benefits consumers

What Challenges Remain?

Geographic Disparities

Coastal Properties Still Struggling:

Miami Beach, Sunny Isles Beach, Key Biscayne:

- Oceanfront properties: Premiums still $10,000-$20,000+

- Rate decreases minimal or non-existent (high-risk profile)

- Limited carrier options (many won’t write coastal)

Fort Lauderdale, Hollywood Beaches:

- Similar challenges to Miami Beach

- Slightly better availability than ultra-luxury areas

Inland Properties (Brickell, Coral Gables, Pinecrest):

- Seeing more meaningful rate decreases

- Greater carrier competition

- Premiums still elevated but improving

Rural/Non-Coastal:

- Best rate improvement

- Most competitive market

- Premiums approaching pre-crisis levels

Takeaway: Location determines experience—inland properties benefiting most from reforms.

Older Buildings and Condos

Condo Market Complexities:

Surfside Effect:

- Post-collapse regulations requiring inspections, repairs

- Special assessments common

- Insurers wary of older condo buildings

Concrete Challenges:

- Buildings 40+ years facing “milestone inspections”

- Structural issues driving insurance denials/non-renewals

- Some buildings becoming uninsurable

HOA Insurance:

- Master policy costs still elevated

- Passed through to unit owners via HOA fees

- Individual unit insurance improving but HOA costs remain high

Example – Typical Brickell Condo:

- Unit owner insurance: -5% decrease (good news)

- HOA master policy: +10% increase (offsetting individual savings)

- Net impact: Minimal improvement or slight increase

Single-Family Older Homes:

- Homes 30+ years also facing scrutiny

- Roof age critical (many carriers require <15 years)

- Electrical, plumbing updates may be required

Newer Construction:

- Seeing strongest rate decreases

- Carriers prefer modern building codes, systems

- Miami Design District, Edgewater, Wynwood new condos more competitive

Claims History Impact

Individual Risk Factors:

Prior Claims:

- Homeowners with 2+ claims in 5 years: Higher premiums persist

- Hurricane claims particularly impactful

- Water damage claims red flag

No-Claims Discounts:

- Homeowners with clean claims history: Best rate improvement

- 5+ years no claims: Premium pricing advantages

Credit Score:

- Florida allows credit-based insurance scoring

- Poor credit = higher premiums (regardless of reforms)

Property Condition:

- Well-maintained homes: Lower premiums

- Deferred maintenance: Higher premiums or denials

Takeaway: Reforms help market overall but individual circumstances still determine rates significantly.

Hurricane Season Volatility

2024-2025 Hurricane Activity:

- Relatively quiet 2024 season = insurer profitability

- If major hurricane hits 2025-2026: Rate increases could return

- Market remains vulnerable to catastrophic loss events

Climate Change:

- Long-term sea-level rise and storm intensity concerns

- Some insurers limiting coastal exposure regardless of reforms

- Existential question: Is coastal Florida insurable long-term?

Mitigation Credits:

- Homes with storm shutters, impact windows, reinforced roofs get discounts

- Mitigation can offset 10%-30% of premiums

- Becoming mandatory for competitive rates

How Homeowners Can Capitalize on Improving Market

Shopping is Essential

Why Rates Vary Dramatically:

- Same property can have $4,000 quote from one insurer, $7,000 from another

- Carrier risk models differ

- Each insurer targets different segments

Action Steps:

1. Get Multiple Quotes:

- Minimum 3-5 quotes

- Use independent agent (access to multiple carriers) vs. captive agent (single company)

- Online comparison tools (PolicyGenius, Insurify) supplement agent quotes

2. Annual Shopping:

- Even if satisfied, shop annually during renewal

- Market changing rapidly—new carriers entering constantly

- Loyalty doesn’t pay in insurance (no rewards for staying)

3. Consider Lesser-Known Carriers:

- New entrants often offer aggressive pricing to gain market share

- Verify financial strength (A.M. Best rating of A- or better)

- Don’t sacrifice quality for marginal savings

4. Bundle Discounts:

- Home + auto with same carrier: 10%-25% discounts

- Umbrella policy: Additional discounts

- Multi-policy can offset higher base rates

Mitigation Investments Pay Off

High-ROI Upgrades:

Impact Windows/Shutters:

- Cost: $15,000-$40,000 (whole home)

- Premium savings: 10%-30% annually

- Payback: 3-7 years

- Added benefit: Hurricane protection, noise reduction, energy efficiency

Roof Replacement:

- Cost: $15,000-$35,000 (typical single-family)

- Premium savings: 10%-20% for new roof vs. 20-year-old roof

- Payback: 5-10 years

- Added benefit: Prevents water damage, increases home value

Plumbing Updates:

- Re-piping: $5,000-$15,000

- Premium impact: May enable coverage where previously denied

- Added benefit: Prevents catastrophic water damage

Electrical Panel Upgrade:

- Cost: $2,000-$5,000

- Premium impact: Required for many carriers

- Added benefit: Safety, capacity for EV charging

Wind Mitigation Inspection:

- Cost: $75-$150

- Documents hurricane resistance features

- Often unlocks discounts homeowners didn’t know existed

- Do this immediately—highest ROI action

Four-Point Inspection:

- Cost: $150-$300

- Required for homes 30+ years

- Documents roof, electrical, plumbing, HVAC condition

- Helps secure coverage

Understanding Coverage Options

Balancing Premium vs. Protection:

Higher Deductibles:

- Increasing deductible from 2% to 5% (or $2,500 to $10,000): -15% to -30% premium

- Risk: Out-of-pocket in claim event

- Strategy: Good for financially secure homeowners with emergency fund

Reducing Coverage Limits:

- Insuring for actual replacement cost vs. inflated

- Remove unnecessary endorsements

- Caution: Don’t underinsure—leaves you exposed

Actual Cash Value vs. Replacement Cost:

- ACV policies cheaper but pay depreciated value

- RCV more expensive but rebuilds to current standards

- Recommendation: Always choose RCV for primary residence

Flood Insurance Separate:

- Homeowners policies don’t cover flooding

- Coastal properties: Flood insurance mandatory (mortgage requirement)

- NFIP (federal) or private flood insurance

- Costs vary: $500-$5,000+ annually

Timing Matters

When to Shop:

- 60-90 days before renewal: Optimal window

- Gives time to compare, negotiate

- Avoid last-minute panic

Market Timing:

- Post-hurricane season (Nov-Dec): Insurer appetite higher

- Pre-hurricane season (May-June): Tighter market

- Shop in fall for best results

New Home Purchase:

- Get insurance quotes BEFORE closing

- Include insurance costs in affordability analysis

- Brickell condo buyer should budget $2,000-$4,000 annually

- Miami Beach oceanfront buyer should budget $8,000-$15,000+ annually

What This Means for Real Estate Markets

Condo Market Recovery Potential

The Affordability Equation:

2022-2023 Condo Crisis:

- HOA fees: $500-$800/month

- Special assessments: $10,000-$50,000

- Insurance (master + unit): $5,000-$10,000 annually

- Result: Monthly carrying costs $1,500-$2,500+ → sales collapsed

2025 Improving:

- Insurance decreasing 5%-10% → -$250 to -$1,000 annually

- Special assessments stabilizing (post-Surfside compliance)

- HOA fees moderating

- Result: Affordability improving marginally

Not Solved, But Better:

- Condo market won’t return to 2019 affordability

- But stabilization enables transactions

- Buyers re-entering Brickell, Edgewater, Sunny Isles markets

Single-Family Market Support

Insurance as Buying Decision:

Previously:

- Buyers walking from deals when quotes exceeded budgets

- Sellers reducing prices to compensate for insurance costs

- Properties sitting unsold due to insurance unavailability

Currently:

- Improving insurance market removes objection

- Buyers more confident in affordability

- Particularly benefits Coral Gables, Pinecrest, Coconut Grove single-family

Price Impact:

- Insurance reform unlikely to drive dramatic price appreciation

- But removes headwind preventing sales

- Market can normalize based on supply/demand vs. insurance crisis

Coastal Property Stabilization

The Persistent Challenge:

High-End Coastal:

- Miami Beach, Sunny Isles Beach, Key Biscayne, Golden Beach

- Insurance still $10K-$25K annually for luxury properties

- Limits buyer pool to ultra-wealthy unaffected by costs

Mid-Market Coastal:

- Hollywood, Dania Beach, Hallandale

- Insurance improving but still elevated ($6K-$12K typical)

- Middle-class buyers struggling with costs

Inland “Safe Harbors”:

- Coral Gables (inland from coast), Pinecrest, Weston

- Best insurance improvement

- May attract buyers deterred by coastal costs

Long-Term Question:

- Are coastal markets entering permanent “luxury-only” phase?

- Middle-class coastal ownership becoming impossible?

- Climate + insurance = only wealthy can afford beach?

Legislative Next Steps and Future Reforms

What’s Working vs. What Needs Improvement

Success:

- Tort reforms dramatically reduced litigation

- Market competition returning

- Rate decreases beginning

Remaining Issues:

- Coastal properties still challenged

- Condo market insurance incomplete solution

- Climate resilience inadequate

Potential 2025-2026 Reforms

Under Discussion:

Mitigation Incentives:

- Tax credits for hurricane upgrades

- Low-interest loans for mitigation

- Mandatory mitigation for coastal properties

Condo-Specific Reforms:

- Separate regulatory framework for condo insurance

- State-backed reinsurance specifically for condos

- Addressing special assessment + insurance double-burden

Climate Adaptation:

- Coastal building code strengthening

- Retreat from highest-risk areas (buyouts)

- Long-term resilience planning

Insurance Innovation:

- Parametric insurance (automatic payouts based on hurricane category)

- Microinsurance for specific perils

- Technology-driven underwriting (drones, AI)

Political Dynamics

2025 Legislative Session:

- Insurance remains top priority

- DeSantis wants to cement legacy of “fixing insurance”

- Bipartisan support continues

Industry Position:

- Insurers happy with reforms, want stability

- Resistance to new regulations

- Support for mitigation incentives (reduces their costs)

Consumer Advocacy:

- Homeowner groups want faster relief

- Condo owners need targeted solutions

- Coastal residents seeking climate adaptation

Conclusion: Progress, Not Perfection

Florida’s 2023 insurance reforms are delivering measurable results: 17 insurance companies filing rate decreases represents a dramatic reversal from the endless premium increases of 2019-2023. The legislative gamble—attacking litigation abuse, stabilizing the market through tort reform and reinsurance support—is paying dividends for homeowners who faced extinction-level crisis just two years ago.

For a Florida homeowner paying $7,000 annually for property insurance in 2023, a -8% decrease to $6,440 in 2025 delivers $560 in annual savings. While not restoring 2019’s $2,500 premiums, the directional change—down instead of relentlessly up—signals fundamental market healing.

The reforms haven’t solved every challenge: Miami Beach oceanfront owners still pay $15,000+ annually, Brickell condo owners juggle unit insurance plus HOA master policy costs, and older buildings throughout South Florida struggle to find coverage at any price. Climate change, hurricane volatility, and coastal exposure create structural challenges no legislation can fully address.

But context matters: In 2022-2023, Florida’s insurance market was in death spiral—carriers fleeing, premiums doubling, properties becoming uninsurable, real estate transactions collapsing. The state faced potential economic catastrophe if insurance unavailability made homeownership impossible.

Two years later, the market is stabilizing: Companies are competing for business, premiums are declining in many segments, and Citizens Property Insurance is shrinking (reducing taxpayer risk). The crisis isn’t over, but the trajectory has reversed from catastrophic to manageable.

For current homeowners, the path forward is clear: shop aggressively (get 5+ quotes), invest in mitigation (impact windows, new roofs pay for themselves), and monitor the market (review coverage annually as competition increases).

For prospective buyers considering Coral Gables estates, Coconut Grove waterfront, Pinecrest family homes, or Brickell condos, improving insurance affordability removes a significant obstacle to homeownership. Budget carefully—insurance remains expensive—but know that market trends favor stabilization rather than continued crisis.

Florida’s insurance story isn’t “problem solved”—it’s “emergency averted, long-term challenges remain.” But in a state where homeowners faced potential insurance apocalypse, averting emergency counts as major victory. The 17 companies filing rate decreases aren’t just statistics—they’re tangible proof that sound policy, political will, and market forces can collaborate to rescue homeowners from crisis.

For Florida real estate, insurance stabilization is the foundation enabling everything else: sales transactions, property values, economic growth, and confidence in long-term homeownership. Good news for Florida homeowners, indeed.

Is Your Insurance Renewal Coming Up?

Let us connect you with trusted insurance professionals who can help you find the best rates in this new market.

Ready to Capitalize on the Improving Market?

Whether you’re buying, selling, or just want to understand how these changes affect your property’s value, we’re here to help.