Miami Housing Market Trends 2025: Florida’s Two-Tier Reality

Florida’s housing market in 2025 presents a tale of two realities. While mid-market residential properties across much of the state experience cooling conditions with rising inventory and price reductions, Miami’s luxury segment—particularly properties exceeding $1 million—demonstrates remarkable resilience with strong sales velocity, limited supply, and sustained price appreciation.

Understanding this market segmentation is critical for buyers, sellers, and investors navigating Florida real estate. The factors driving cooling in Tampa, Orlando, and Cape Coral differ substantially from dynamics in Miami’s high-end neighborhoods like Coconut Grove, Coral Gables, and Fisher Island. Buyers expecting uniform market conditions across Florida will misunderstand opportunities and risks in their target submarkets.

This analysis examines Florida’s cooling markets, Miami’s luxury segment strength, and strategic implications for buyers and sellers operating in this two-tier environment.

Understanding Florida’s Mixed Housing Market Signals

Florida real estate cannot be analyzed as a monolithic market. The state comprises dozens of distinct metropolitan areas, each with unique supply-demand dynamics, price points, buyer demographics, and external factors influencing performance.

Recent data from Redfin, CondoBlackBook, and regional MLS systems reveals stark performance differences across Florida markets. While western coastal cities like North Port, Tampa, and Cape Coral experience inventory surges exceeding 60% year-over-year, Miami’s ultra-luxury segment ($10 million+) reports sales increases of 115% during the same period. These divergent trends reflect fundamentally different market forces rather than temporary timing variations.

For real estate professionals and consumers, recognizing these differences prevents misapplication of statewide trends to local decision-making. A buyer relying on headlines about “Florida’s cooling market” might incorrectly assume Miami luxury condos offer negotiation opportunities, while that same buyer could miss genuine value in Fort Myers or Tampa where sellers face legitimate market pressures.

The two-tier phenomenon extends beyond simple geography. Within individual cities—including Miami—price point segmentation creates distinct submarkets. Properties under $500,000 face different supply-demand conditions than those between $1-3 million, which in turn differ from ultra-luxury assets exceeding $10 million. Each tier attracts different buyer pools, financing dynamics, and price sensitivity to external economic factors.

Florida’s Fastest-Cooling Housing Markets in 2025

According to Redfin’s comprehensive analysis ranking the 100 most populous U.S. metropolitan areas, six of the ten fastest-cooling housing markets are located in Florida. These markets share common characteristics driving rapid deceleration from pandemic-era boom conditions.

West Coast Florida Leading the Cooldown

Florida’s western coastal regions—particularly the corridor from Tampa through Fort Myers and down to Naples—have experienced the most dramatic cooling. These markets, which saw explosive price appreciation from 2020-2023 as remote workers and retirees relocated from higher-cost states, now face supply-demand rebalancing that favors buyers.

The cooling manifests through multiple measurable indicators including inventory surges exceeding historical norms, extended days on market compared to previous years, increasing percentages of sellers reducing asking prices, declining sale-to-list price ratios, and price per square foot stabilization or modest decreases. These metrics collectively indicate markets transitioning from seller-favorable conditions to more balanced or buyer-favorable environments.

North Port, Tampa, and Cape Coral Inventory Surge

North Port leads the nation as the fastest-cooling housing market, with inventory up 68% year-over-year—the second-largest increase among major metropolitan areas analyzed. The median price per square foot declined 1.2%, making North Port one of only four metros nationally where prices actually decreased. Additionally, 42.6% of sellers dropped asking prices, up from 36% the previous year.

Cape Coral follows closely with inventory up 64%, median price per square foot down 2.9%, and 37.5% of sellers reducing prices compared to 32.9% a year earlier. According to Cotality’s recent analysis, Cape Coral experienced a 7.1% annual home price drop—the second-fastest price decline nationally.

Tampa, Florida’s third-largest metropolitan area, also ranks among the top cooling markets despite its size and economic diversity. The combination of substantial new construction, elevated insurance costs following Hurricane Ian and other recent storms, and moderating migration from northeastern states has created oversupply relative to current demand.

In April 2024, the median time a Florida home spent on the market reached 53 days, up nine days from the year before. By late 2025, many western Florida markets reported days on market exceeding 60-80 days—a dramatic shift from the 2021-2022 period when homes routinely sold within days of listing.

Orlando, Jacksonville, and Lakeland Market Dynamics

Central and northeastern Florida markets also appear prominently on cooling market lists. Orlando, Florida’s tourism and theme park capital, ranks fourth nationally among cooling markets despite its diverse economy and continued population growth.

Jacksonville, northeast Florida’s largest city, faces inventory increases and extended marketing times as new construction deliveries outpace absorption. The market, which attracted substantial migration during the pandemic from buyers seeking affordability relative to Southeast Florida, now deals with oversupply in specific neighborhoods and price segments.

Lakeland, positioned between Tampa and Orlando in central Florida, rounds out the state’s cooling markets. This smaller metropolitan area benefited from pandemic-era remote work flexibility as buyers sought larger homes and lower costs compared to coastal cities. As work-from-anywhere arrangements have normalized and some workers returned to offices, Lakeland’s demand moderated while new construction continued delivering inventory.

Why These Markets Are Cooling Rapidly

Several interconnected factors drive cooling in Florida’s western and central regions, most tied to the state’s increasing climate risk exposure and its consequences.

Intensifying natural disasters represent the primary concern. Hurricanes, floods, and severe weather events have become more frequent and destructive in Florida. Hurricane Ian in 2022 destroyed 5,000 homes and damaged nearly 30,000 more in the Cape Coral metro alone. The 2024 hurricane season brought additional destruction, reinforcing perceptions of elevated risk in coastal Florida regions.

These disasters directly impact homeowner insurance costs. Florida’s insurance crisis has pushed premiums to levels that shock buyers and strain existing homeowners’ budgets. Many homeowners report insurance jumping by thousands of dollars annually. A Redfin survey found 70% of Florida homeowners experienced recent insurance cost increases. Some properties have become effectively uninsurable through standard markets, forcing owners into Citizens Property Insurance (Florida’s insurer of last resort) at premium rates.

HOA fees and special assessments have surged following Florida’s post-Surfside condo safety legislation. New building reserve requirements, structural inspections, and mandatory repairs create assessment pressures particularly acute in older condominium buildings. Monthly HOA fees in some buildings have doubled or tripled as associations fund reserve accounts and complete required repairs.

New construction oversupply compounds demand challenges. Florida is building more new homes than any state except Texas. This building boom, initiated when demand peaked in 2021-2022, continues delivering inventory precisely when buyer demand has cooled due to elevated mortgage rates and economic uncertainty. The oversupply particularly impacts markets like Tampa and Cape Coral where large tracts of developable land facilitated rapid construction.

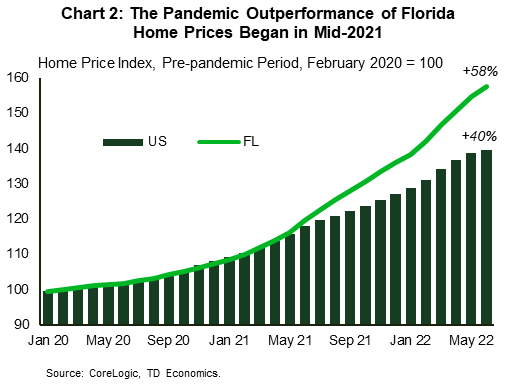

Soaring home prices during the pandemic created affordability constraints. Although prices in some Florida markets have started declining, homes remain substantially costlier than pre-2020 levels. This price appreciation, combined with mortgage rates in the 6-7% range, has priced out many buyers who could have afforded purchases when rates were 3%.

Miami’s Luxury Segment Defies State-Wide Trends

While much of Florida experiences cooling, Miami’s luxury real estate market—particularly the ultra-high-end segment—demonstrates remarkable strength that defies both state-wide trends and broader national housing market headwinds.

Ultra-Luxury ($10M+) Sales Up 115% Year-Over-Year

Miami’s ultra-luxury segment, defined as properties exceeding $10 million, reported extraordinary performance through the first seven months of 2025. Sales increased 115% year-over-year, representing not merely statistical achievement but validation of Miami’s transformation into a global financial and lifestyle destination attracting the world’s most discerning buyers.

This sales surge occurred despite economic conditions that typically constrain luxury real estate including mortgage rates in the 6-7% range (though many luxury buyers purchase with cash), broader stock market volatility during portions of 2024-2025, and general economic uncertainty affecting consumer confidence. The fact that ultra-luxury sales doubled during this environment indicates demand driven by fundamental factors rather than speculative momentum.

Specific transactions illustrate this strength. A waterfront estate on Pine Tree Drive in Miami Beach sold for $105 million before being relisted at a higher price point. The 16,900-square-foot residence commands $9,994 per square foot—setting new benchmarks for luxury pricing. Such transactions demonstrate that Miami’s most exceptional properties continue finding buyers willing to pay record prices for trophy assets.

The $5-10 million segment also performed well, with inventory absorption rates and price per square foot metrics indicating strong demand. CondoBlackBook’s Q2 2025 Miami Luxury Condo Market Summary noted that properties above $5 million “shouldered much of this season’s momentum” with the ultra-luxury tier remaining “especially resilient, holding steady year-over-year in both sales volume and price per square foot.”

Waterfront Properties and Trophy Assets Resilient

Within Miami’s luxury market, waterfront properties and trophy assets in the most prestigious neighborhoods demonstrate particular strength. Waterfront scarcity—Miami Beach, for example, cannot create new land or expand coastlines—ensures that supply remains permanently limited while demand continues growing.

Fisher Island emerged as Miami’s most popular luxury district in Q2 2025, leading market growth with the highest percentage increase in year-over-year sales. The exclusive island, accessible only via ferry, yacht, or helicopter, represents the ultimate in privacy and exclusivity that ultra-wealthy buyers prioritize.

Coconut Grove and Coral Gables combined outperformed other Miami submarkets, posting 8.8% sales growth when other areas reported declines. These low-density residential enclaves offering nature connections and proximity to prestigious marinas attract buyers valuing tranquility over urban energy. Coconut Grove specifically has “virtually run out of large condos,” with developments like Park Grove experiencing strong absorption as buyers compete for limited quality inventory.

Miami Beach’s premium neighborhoods—South of Fifth, Star Island, Palm Island, Venetian Islands—maintain pricing power due to finite supply, waterfront access, and established prestige. Even as mid-market Miami Beach condos experience modest price adjustments, trophy properties continue trading at or above asking prices when sellers price realistically.

High-Net-Worth Migration Sustaining Demand

Miami’s luxury market strength stems from sustained migration of high-net-worth individuals from high-tax states and international locations. Unlike pandemic-era migration driven partly by temporary remote work arrangements, current migration reflects permanent relocations motivated by tax strategy, business opportunities, and lifestyle preferences.

The concentration of family offices, financial services firms, cryptocurrency companies, and technology businesses relocating to or expanding in Miami creates a self-reinforcing cycle. Executives follow their companies or competitors to Miami, generating luxury real estate demand independent of broader housing market trends. This business ecosystem ensures Miami’s luxury market operates somewhat decoupled from mid-market residential dynamics.

International buyers particularly from Latin America, Europe, and Canada represent substantial portions of Miami luxury purchases. These buyers often operate on different economic cycles than U.S. domestic markets, providing demand stability when U.S. buyers face headwinds. Currency advantages for international buyers when the U.S. dollar weakens against their home currencies further support demand.

Cash purchases dominate Miami’s ultra-luxury segment, insulating these transactions from mortgage rate impacts. Analysis indicates that deals above $2,000 per square foot or $10 million+ routinely involve all-cash buyers on both sides. This financing independence allows Miami’s luxury market to perform well even during periods when mortgage rates constrain mid-market activity.

The Two-Tier Market Phenomenon Explained

Florida’s housing market segmentation into distinctly performing tiers reflects fundamental differences in buyer profiles, financing dynamics, supply constraints, and price sensitivity to external economic factors.

Mid-Market Cooling vs. Luxury Market Strength

The mid-market segment—broadly properties between $300,000-$800,000—faces the most significant headwinds in Florida’s 2025 market. These properties attract buyers most sensitive to mortgage rates, rely heavily on financed purchases, compete with substantial new construction inventory, and serve buyers whose purchasing power has been compressed by rate increases.

When 30-year fixed mortgage rates climbed from 3% to 7%, the monthly payment on a $500,000 home increased by over 60%. This rate shock immediately priced out a significant portion of mid-market buyers, leading to reduced demand, increased days on market, and price reductions in markets with ample supply.

The luxury market, conversely, is less sensitive to mortgage rates due to the prevalence of cash buyers and the high net worth of the buyer pool. Their purchasing power is driven more by global wealth trends, stock market performance, and tax migration strategies than by domestic mortgage rates.

Geographic Segmentation: Coastal vs. Inland Markets

The two-tier market also manifests geographically. Coastal markets with structural supply constraints (like Miami Beach, Fisher Island, and Key Biscayne) and established concentrations of wealth and business activity. These structural advantages support pricing power even during broader market cooling.

Inland markets and smaller coastal cities lack these advantages. Cape Coral, while waterfront, doesn’t offer Miami’s business ecosystem or international appeal. Orlando, though economically diverse, competes with abundant developable land that allows continuous supply expansion. These markets face greater volatility and price sensitivity because they lack the structural supply constraints and demand drivers that support premium coastal markets.

This geographic divide will likely persist. As climate risks intensify, buyers may increasingly concentrate in markets with perceived lower risk or where the value proposition (e.g., Miami’s global city status) outweighs the risk premium.

Price Point Divisions and Buyer Demographics

The price point division reflects distinct buyer demographics:

- Mid-Market ($300K-$800K): Primarily domestic, first-time, or move-up buyers, highly rate-sensitive, reliant on financing, and competing with new construction.

- Luxury ($1M-$10M): Mix of domestic and international buyers, less rate-sensitive, often cash or low-leverage financing, seeking lifestyle and investment.

- Ultra-Luxury ($10M+): Predominantly high-net-worth individuals, all-cash, international, tax migrants, seeking trophy assets and privacy.

The strength of the ultra-luxury tier provides a “trickle-down” effect, supporting the upper end of the luxury market, while the mid-market struggles with affordability and oversupply.

Natural Disasters, Insurance, and HOA Cost Impacts

The increasing cost of ownership due to climate risk and regulatory changes is a major factor driving the two-tier market.

Hurricane Insurance Skyrocketing in West Florida

Markets like Cape Coral and Tampa have seen the most dramatic increases in property insurance costs following recent hurricane seasons. These costs directly impact affordability and buyer demand in the mid-market segment.

Special Assessments and Building Safety Requirements

The post-Surfside condo safety laws (SIRS) have led to massive special assessments in older condominium buildings, particularly in Miami-Dade and Broward. These assessments act as a sudden, large price increase, further straining the mid-market buyer’s budget and increasing the risk associated with older inventory.

How Miami’s Market Differs from Southwest Florida

While Miami faces the same insurance and SIRS challenges, the high-net-worth buyer pool in the luxury segment is better equipped to absorb these costs. For a $10 million buyer, a $50,000 annual insurance premium is a smaller percentage of their total investment than it is for a $500,000 buyer. This financial resilience allows the Miami luxury market to remain robust despite rising ownership costs.

New Construction Supply Dynamics

Supply is a critical differentiator between the cooling markets and Miami’s resilient luxury segment.

Florida Building More Homes Than Any State Except Texas

Florida’s overall building boom has created an oversupply issue in many mid-market areas, particularly where land is abundant (e.g., Tampa, Orlando, Cape Coral). This new inventory competes directly with existing homes, forcing price reductions.

Oversupply Pressures in Specific Submarkets

The oversupply is most acute in the mid-market single-family and townhome segments of inland and western Florida markets.

Miami’s Controlled Development and Supply Constraints

Miami’s luxury market, particularly the waterfront and prime urban core, benefits from extreme supply constraints. There is virtually no land left to develop in areas like Fisher Island, South of Fifth, or Coconut Grove. New construction is limited to high-cost, high-rise projects that cater exclusively to the luxury tier, preventing oversupply in the high-end segment.

Strategic Opportunities for Mid-Market Buyers

The cooling markets present opportunities for buyers who can navigate the current financial landscape.

Price Reductions and Negotiation Leverage

In cooling markets like North Port and Cape Coral, buyers have significant negotiation leverage. Price reductions are common, and sellers are more willing to offer concessions (e.g., paying closing costs, buying down the mortgage rate).

Inventory Selection Advantages

The surge in inventory gives buyers more choices and time to make decisions, a stark contrast to the bidding wars of 2021-2022.

Where Value Exists in Cooling Markets

Value exists in well-maintained properties in desirable neighborhoods within the cooling markets, particularly those that have already addressed insurance or assessment issues.

Luxury Buyers and Sellers: Miami Market Strategy

The strategy for the Miami luxury market remains focused on quality and scarcity.

Why Ultra-Luxury Remains Strong Despite Rate Increases

The strength is driven by global wealth migration, tax advantages, and the perception of Miami as a safe haven for capital and a world-class city. These factors outweigh the impact of domestic interest rates.

Neighborhoods Outperforming: Coconut Grove, Coral Gables, Fisher Island

These neighborhoods continue to outperform due to their limited supply, high security, and established prestige. Buyers should focus on these areas for long-term value appreciation.

Timing Considerations for $1M+ Properties

Sellers of $1M+ properties should price realistically but can expect strong demand for truly unique or waterfront assets. Buyers should act quickly when a trophy property becomes available, as competition remains fierce at the very top end of the market.

Ready to Invest in Miami’s Luxury Market?

Whether you are seeking a primary residence, a strategic investment, or a multi-unit compound, our team specializes in navigating the exclusive South Florida luxury real estate market. Contact us today for confidential, expert guidance.